Our Investment Philosophy

conviction in uncertainty

patience through volatility

courage to see opportunity where others see risk

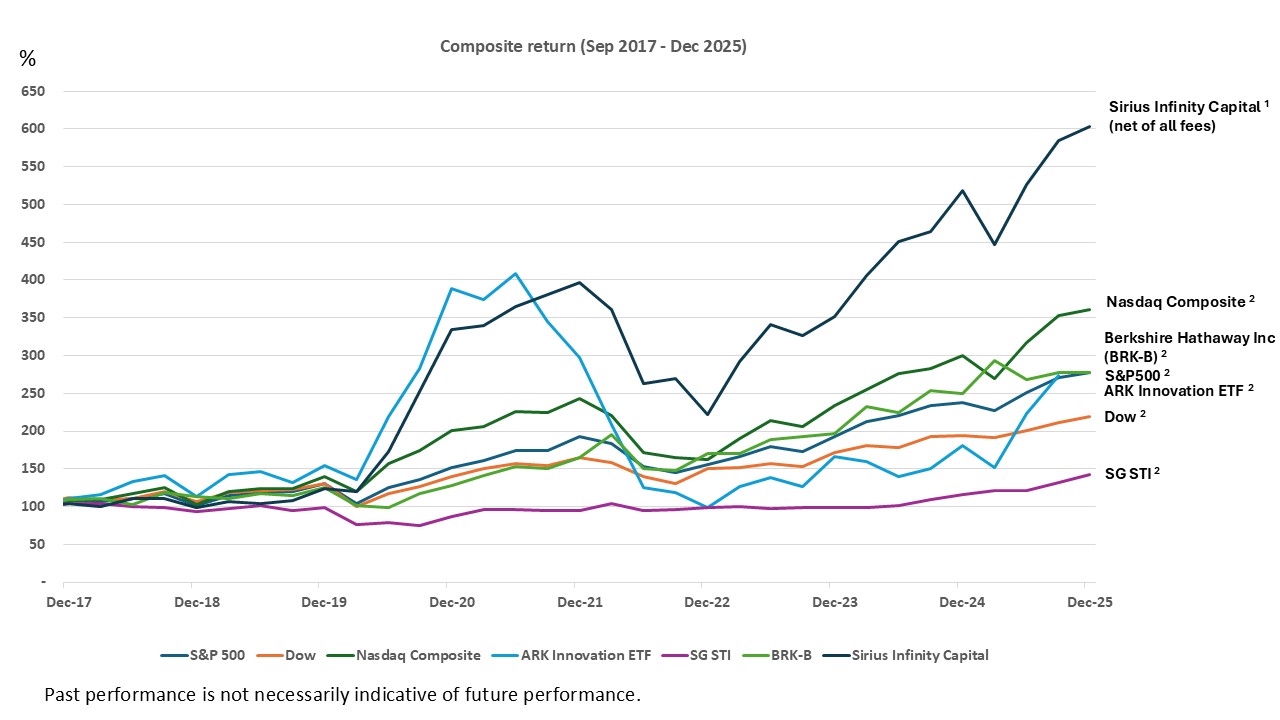

Our Performance Since Inception

Source:

1 Sirius Infinity Capital: Phillip Securities Pte Ltd. The Average performance is denominated in SGD. Average performance returns (the “Performance”) for period more than 1 year are annualised. The Performance represent past performance and are not indicative of future or current performance which may be higher or lower. The Performance is based on unaudited results of client accounts and includes reinvestment of dividends and income and, is net of all fees except performance fees (if any) which are included only at year end. Individual portfolio returns may vary from the Performance returns.

2 Nasdaq Composite, Berkshire Hathaway Inc (BRK-B), S&P500, Dow, ARK Innovation ETF, SG STI: Respective indices, stock and ETF’s historical returns, which are available on public domain.

Our Investment Strategy

is rooted in 4 key principles

- Investing for the long term – not speculating on short-term market moves

- Strong focus on identifying global and future trends

- Backed by in-depth research and analysis of high-growth companies

- Primarily investing in large-cap, blue-chip companies